As yields on conventional savings accounts hover close to record lows, Singaporean retail investors are increasingly turning to structured products, such as credit-linked notes, as you may have heard. With bank deposit rates averaging less than 1 percent, according to a recent report by the Monetary Authority of Singapore, many of us are being urged to find more intelligent ways to increase our savings. Credit linked notes, which combine bond income potential with a twist of credit risk management, can help with that.

Singapore’s Market, Context, and Credit Risk

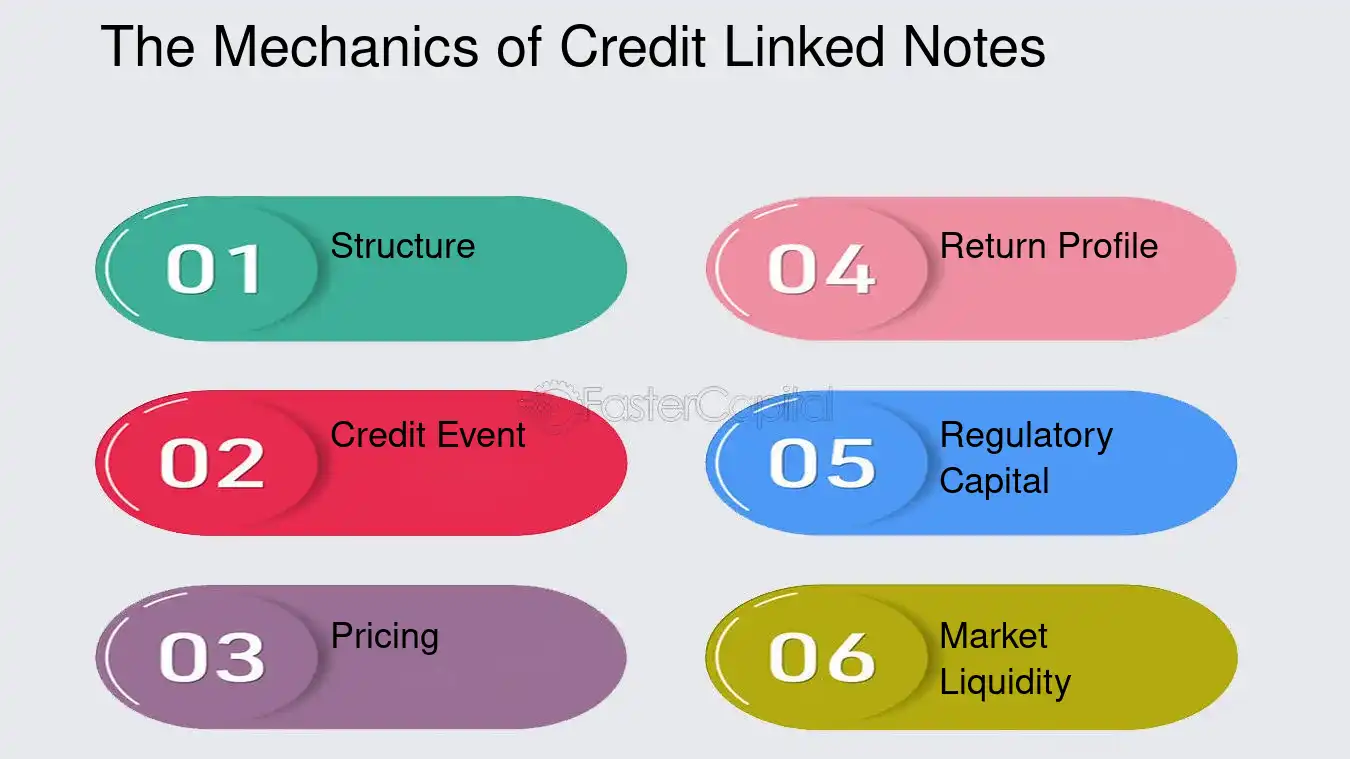

Understanding related concepts is helpful when talking about credit linked notes in Singapore. The possibility of a borrower defaulting is referred to as credit risk. For this reason, credit rating agencies such as S&P and Moody’s are frequently cited in these instruments. They might incorporate aspects of structured finance, such as the use of derivatives to generate a payoff profile that suits your level of risk tolerance.

You feel more secure because of Singapore’s stable regulatory framework and robust financial system. Structured products are closely monitored by the MAS. Transparency entails explicit product disclosures, outlined stress scenarios, and required suitability evaluations. You are not in the dark.

Additionally, the pricing of credit default swaps (CDS) and how it affects yield spreads on credit-linked notes will be discussed. The yield increases with a wider spread, but the perceived risk also increases. The pricing you see when weighing your options at your local branch or on your digital wealth platform is based on that dynamic.

Do Credit-Linked Notes Make Sense for Your Portfolio?

Let us face it, not everyone is a fan of credit-linked notes. You may gravitate toward safer options if you are risk averse and are happiest with shore-deposit insurance programs like the Singapore Deposit Insurance Corporation. However, these notes can help you if you are already diversified across bonds and stocks and you are comfortable with a moderate level of credit risk.

You can ask yourself the following: What is the reference entity’s credit quality? Is it linked to a basket or just one corporate issuer? Do you have a six-month, one-year, or two-year investment horizon? Are you aware of the situations, such as downgrade or default events, where your return may be clipped? Particularly since structured products can feel opaque, ask these questions.

The Significance of It in 2025

If you are looking for more complex yield opportunities in the current low-rate environment, you are not alone. With exposure to credit movement, structured payoff, and possibly higher yield in a regulated setting like Singapore’s, credit linked notes provide a customized link between fixed income and equity-like thinking. Depending on your level of comfort and understanding with credit risk, they can assist you in diversifying.

Finally, because credit linked notes are unique, they stand out. In Singapore’s thriving banking environment, they represent your credit outlook, yield requirements, and preference for structured design.

You can discuss this with your neighborhood bank or wealth advisor for assistance determining whether credit-linked notes align with your objectives or comparing them.