In today’s fast-evolving business landscape, mergers and acquisitions (M&A) have become one of the most strategic ways for companies to grow, expand market reach, and strengthen competitive advantage. However, even though mergers offer tremendous potential, many fail to achieve their expected results due to poor planning, cultural clashes, and weak post-merger integration. This is where M&A consulting services play a vital role — turning what could be a risky move into a smooth and successful transition.

As we move through 2025, the business environment has become more complex, with market volatility, evolving regulations, and technological disruptions shaping every strategic decision. Companies now rely more than ever on expert consultants to navigate this dynamic landscape and ensure that mergers deliver real, measurable value.

The Changing Landscape of M&A in 2025

The global economy in 2025 is defined by innovation and competition. Businesses are increasingly pursuing M&A not just to grow in size, but to accelerate digital transformation, tap into new markets, or acquire technological capabilities. Sectors such as healthcare, fintech, renewable energy, and software are leading this wave, with companies seeking synergies that can boost performance and profitability.

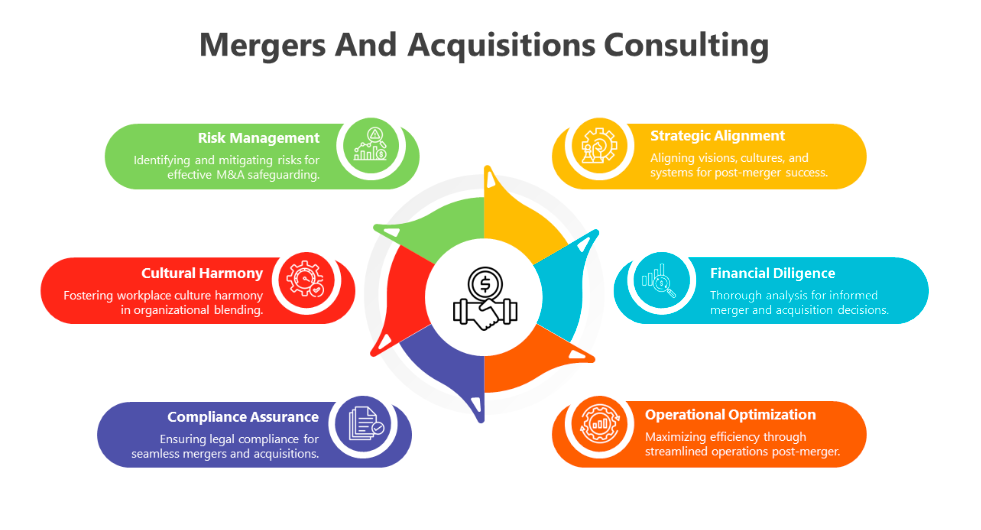

However, the stakes are high. A single miscalculation in valuation, cultural alignment, or integration can lead to significant losses. This is why the demand for specialized Mergers and Acquisitions Consulting has risen sharply in recent years. Consulting firms bring the expertise, analytical tools, and strategic foresight needed to guide companies through each stage of the process — from deal sourcing and valuation to negotiation and integration.

How M&A Consulting Firms Add Strategic Value

M&A consultants are not just advisors; they act as strategic partners who help businesses uncover the best opportunities while minimizing risks. Their value lies in their ability to combine financial expertise, industry insights, and operational know-how.

- Comprehensive Due Diligence

Before any merger, due diligence is critical. Consultants conduct deep financial, operational, and legal evaluations to ensure the target company’s performance aligns with expectations. They identify potential red flags early, giving the buyer clarity and confidence before making a final decision. - Accurate Valuation and Deal Structuring

Determining the right value of a company is one of the most challenging aspects of an M&A deal. Consulting experts use advanced valuation models and market data to assess both tangible and intangible assets. They help clients structure deals that are fair, sustainable, and strategically beneficial in the long run. - Cultural and Organizational Integration

Many mergers fail not because of financial issues but due to cultural misalignment. Consultants facilitate smooth integration by aligning company values, leadership styles, and communication structures. This helps maintain employee morale and ensures a unified company culture post-merger. - Regulatory and Compliance Guidance

In 2025, regulatory scrutiny over mergers has intensified globally. Consulting firms help businesses comply with antitrust laws, financial reporting standards, and local market regulations. Their guidance reduces legal risks and prevents potential deal delays. - Post-Merger Integration (PMI)

The real success of a merger is often seen after the deal closes. Consultants play a crucial role in post-merger integration — ensuring systems, operations, and teams work cohesively. Their focus on synergy realization helps the newly formed entity reach its projected performance goals.

Technology’s Role in Modern M&A Consulting

Technology has revolutionized how M&A consulting services operate in 2025. Artificial intelligence, big data analytics, and automation tools now play a central role in decision-making. Consultants use predictive analytics to identify high-potential targets, assess market sentiment, and forecast post-merger outcomes with greater accuracy.

For example, AI tools help consultants analyze thousands of data points — from financial records to social media activity — to provide a clearer picture of a target company’s reputation and performance. Virtual data rooms also enable secure and efficient information sharing during due diligence, speeding up deal execution while maintaining confidentiality.

These technological advancements not only make M&A consulting more precise but also help businesses stay competitive in fast-changing markets.

Why Businesses Need M&A Consultants in 2025

With industries becoming more global and interconnected, business leaders face greater challenges than ever before. Mergers are no longer just about combining resources; they are about creating strategic value through innovation and synergy. M&A consultants help organizations achieve this by offering a holistic view of the process.

- Objective Decision-Making:

Consultants bring an unbiased perspective, helping companies make rational decisions based on data rather than emotion. - Faster Deal Execution:

With their experience and networks, consultants streamline processes, reducing delays that could affect deal timing or value. - Risk Mitigation:

Every merger carries financial, operational, and cultural risks. Expert consultants identify and address these issues before they escalate. - Sustainable Growth:

Beyond closing the deal, consultants ensure long-term success by focusing on post-merger performance, leadership integration, and cultural alignment.

Case Example: A New Era of Smart Mergers

Take, for instance, the growing number of cross-border mergers in Asia and Europe in 2025. Companies seeking to expand into new markets are turning to M&A consultants to handle complex international regulations, tax implications, and cultural differences. These consultants serve as bridge builders — helping businesses collaborate effectively and unlock mutual growth potential.

Their involvement ensures that even large-scale mergers run smoothly, with minimal disruptions to operations or employee morale. This proactive approach has made consulting firms essential players in driving the success of modern mergers.

The Future of M&A Consulting

Looking ahead, the role of M&A consultants will continue to evolve. As global markets become more digital and data-driven, consulting services will rely even more on advanced analytics, automation, and strategic foresight. Human expertise, however, will remain at the heart of successful deals.

Businesses will continue to depend on consultants not just for technical support but for strategic insight — helping them identify opportunities, manage risks, and build lasting value from every merger.

Conclusion

In 2025, successful mergers are not just about merging businesses — they’re about merging visions, strategies, and people. M&A consulting services act as the catalyst that turns ambitious plans into successful realities. With their blend of analytical precision, industry knowledge, and human insight, consultants are helping businesses navigate complex deals and achieve long-term success.

For any company planning a merger or acquisition, partnering with an experienced consulting firm isn’t just a smart move — it’s the key to turning potential into performance.