Why Accounts Payable Metrics Matter

Managing cash outflows requires a strategic approach beyond the mere payment of bills in the field of Accounts payable (AP). A well-managed AP process enables businesses to enhance their supplier relationships and optimize cash flow while securing early payment discounts. A poorly managed accounts payable process results in delayed payments that create fees and damages supplier relations while reducing the company’s available working capital. An Accounts Payable Dashboard serves as a fundamental tool for such cases.

The correct KPI monitoring transforms AP from basic transaction handling into a strategic financial instrument. Finance managers together with CFOs and AP clerks who understand key metrics will make better decisions at a faster pace to control expenses more effectively.

The Role of Dashboards in Accounts Payable

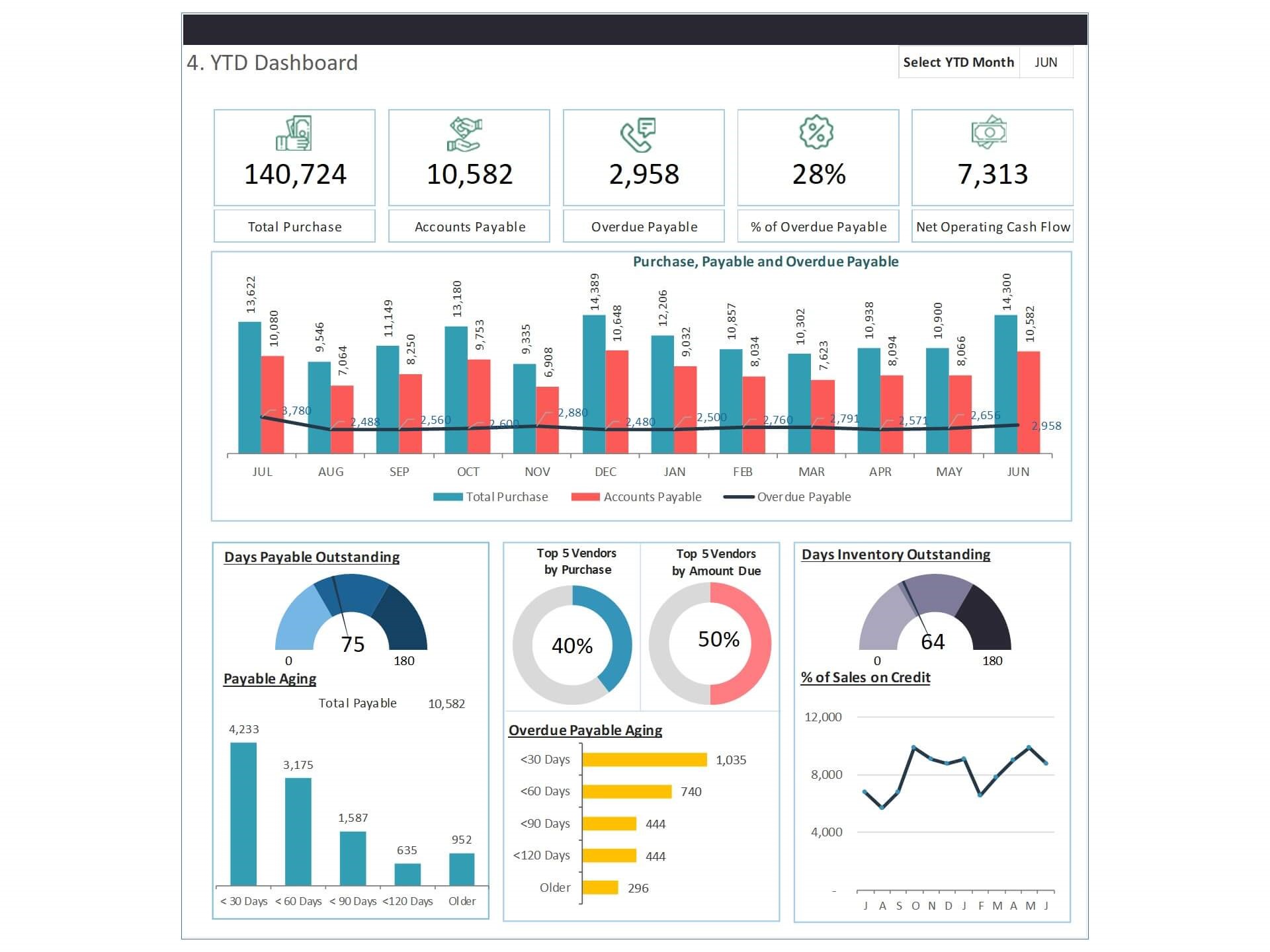

A real-time AP dashboard centralizes payable-related metrics in a visual format that provides a unified view of all relevant data. The platform combines data sources such as due dates and outstanding invoices and payment cycles and supplier metrics from Excel or Power BI and integrated ERP systems. Finance teams can use this system to proactively handle liabilities while controlling payment schedules and discovering cost-saving opportunities through a simple interface.

The following critical metrics should be included in your Accounts Payable Dashboard:

Total Outstanding Payables

This metric displays the complete sum of unpaid invoices that exist in the system. This metric delivers instant information regarding supplier payment obligations at the present moment. The breakdown of this metric by supplier or department and due date enables organizations to decide which payments should be prioritized and prevent delays in making payments.

Days Payable Outstanding (DPO)

DPO quantifies the time needed by your business to complete supplier payments. This financial metric serves as an essential indicator for liquidity and forms part of the cash conversion cycle. Maintaining a longer DPO period allows businesses to keep funds in their possession for extended periods thus enhancing cash management. An excessively extended DPO could result in payment delays which might harm relationships with suppliers.

Formula:

DPO = (Accounts Payable ÷ Cost of Goods Sold) × Number of Days

Businesses can maintain satisfactory supplier relations through DPO trend monitoring while controlling their cash retention period.

Number of Invoices Past Due

The KPI displays a straightforward yet essential metric which counts all overdue invoices. Both the dollar amount and the number of delayed payments serve as indicators of process efficiency. The presence of numerous delayed small invoices might indicate approval process delays or system-related performance issues.

Average Payment Cycle Time

This performance indicator shows the average duration from invoice reception to payment issuance. The length of the payment cycle depends on whether you want early discount benefits or need to use credit terms effectively. A consistent pattern in payment cycle times enables better forecasting for future cash flow operations.

The AP team performance can be evaluated through this metric which shows the percentage distribution of early payments and on-time payments and late payments.

A performance evaluation system for the AP team exists through this breakdown. A well-managed AP process should result in both timely payments and early payments to claim discount benefits. A significant number of delayed payments creates issues in supplier relationships while generating penalty costs.

Discount Capture Rate

Suppliers grant price reductions when customers settle their invoices early by paying within specified timeframes (e.g., 2% discount for payments made within 10 days). The measurement tracks how frequently your organization utilizes these payment benefits. When your company fails to capture discounts you lose potential savings and displays weak cash planning capabilities. Higher capture rates help businesses achieve bottom-line improvements without requiring supplier price changes.

The calculation consists of Discounts Captured divided by Discounts Available multiplied by 100.

Payment Method Breakdown

The analysis of payment methods including check, ACH, wire and credit card functions enables businesses to discover process enhancement and cost reduction possibilities. The conversion from paper checks to ACH payments decreases processing expenses while shortening settlement periods.

The dashboard needs to display payment method statistics with capabilities to analyze data at the vendor and department levels

Supporting Metrics for Strategic Decision-Making

Average Cost per Invoice Processed

The cost measurement evaluates internal expenses needed to process a single invoice while considering labor expenses and system and overhead costs. The use of automated systems results in reduced costs but manual processes lead to higher expenses alongside increased complexity. Organizations need to track this KPI to validate their investments in process automation and process enhancement initiatives.

Number of Invoices Processed per Employee

This indicator enables evaluation of your Accounts Payable team’s efficiency. A low number of invoices processed by each employee indicates training problems or inefficient workflows or system limitations. High invoice processing numbers may indicate employee burnout together with potential deterioration of quality performance.

Supplier Dispute Rate

The high occurrence of invoice disputes points to either bad communication practices or incorrect billing or system data inconsistencies. The tracking system measures the total number or percentage of invoices which need dispute resolution or follow-up. The reduction of this rate enhances both supplier relations and payment processing efficiency.

These Metrics Serve to Enhance Cash Outflow Management Systems

Smarter Payment Timing

AP teams obtain optimal financial returns by monitoring payment timing and due dates and discount opportunities through DPO tracking. The company decides to postpone payments for cash conservation or speed up payments to achieve early discount opportunities and vendor relationship maintenance.

Improved Forecasting and Planning

The finance team obtains precise cash outflow forecasts through current AP data analysis. The company maintains proper funding availability while preventing unexpected liquidity crises.

Enhanced Supplier Negotiations

Your payment statistics for different vendors enable you to secure better deals or request payment term extensions because of your dependable business practices. Vendors value both transparency and predictability so having an AP dashboard delivers these benefits to them.

Fewer Penalties and Better Relationships

Companies that monitor their past-due invoices and processing accuracy prevent late payment penalties and protect supplier goodwill while becoming preferred customers for better terms or pricing opportunities.

Guidelines and Design Recommendations for Building Your AP Dashboard

Use of Visual Indicators

Color-based marking systems (red for late payments and green for timely payments) help users make faster choices. A combination of gauge charts and scorecards enables users to view DPO measurements together with discount success rates and processing precision metrics directly.

Integration with ERP and Accounting Systems

The integration of NetSuite and SAP and QuickBooks and Oracle systems through automated data pulls minimizes manual errors while providing real-time accuracy. Power BI and Excel with Power Query provide joint capabilities to connect numerous platforms for smooth data integration.

Mobile and Print-Ready Views

Your dashboard needs to operate on multiple devices while offering a simple version that works for printing meetings and reporting purposes.

The Best Tools for Developing AP Dashboards

Excel for Custom Templates

The solution works best for businesses with limited business intelligence tools and for small businesses. AP views become interactive through Excel dashboards which leverage pivot tables and slicers together with conditional formatting features. The combination of Power Query with Excel allows for automatic data refreshes.

Power BI for Real-Time Insight

The best choice for businesses with extensive AP operations and complex organizational structures. Power BI provides organizations with dynamic visualizations and real-time dashboards and role-based access features. The solution provides excellent capabilities to merge data from different systems while building an expandable reporting system.

Built-in ERP Dashboards

Most accounting systems from today include built-in dashboards for Accounts Payable functions. The solutions deliver quick benefits, but their custom flexibility might be limited.

Conclusion

The essential KPIs for your system should start with total payables and DPO and aging and discount capture and payment trends. You should start with basic dashboards before adding process and supplier information to gain better understanding and develop your strategic approach.

A properly designed dashboard enables users to access smarter cash outflows through only a few screen interactions. Bizinfograph offers ready-to-use dashboard templates on Finance, Sales, HR and Manufacturing.