Starting your trading journey can feel overwhelming. With countless platforms, strategies, and market terminology flying around, it’s easy to feel lost before you even begin. But here’s the good news: every successful trader started exactly where you are now—at zero. The difference between those who succeed and those who give up isn’t luck or natural talent. It’s about taking the right first steps and building a solid foundation.

This guide will walk you through everything you need to know to make your first trade confidently, from understanding basic concepts to executing your strategy with the right tools and mindset.

Understanding What Trading Actually Means

Before diving into platforms and strategies, let’s clarify what trading really is. At its core, trading involves speculating on whether an asset’s price will rise or fall. Unlike traditional investing, where you might hold stocks for years or decades, trading typically focuses on shorter timeframes—from minutes to months.

When you trade, you’re not necessarily owning the underlying asset. Instead, you’re taking a position on its price movement. Think of it like predicting tomorrow’s weather: if you’re right, you profit. If you’re wrong, you incur a loss. The key is developing the skills to make informed predictions more often than not.

The Markets Available to You

Modern trading platforms open doors to thousands of markets:

- Cryptocurrencies: Bitcoin, Ethereum, and thousands of altcoins

- Forex: Currency pairs like EUR/USD or GBP/JPY

- Indices: Collections of stocks like the S&P 500

- Commodities: Gold, oil, and agricultural products

The crypto market has become particularly attractive for beginners due to its accessibility and round-the-clock trading opportunities. Unlike traditional stock markets that close on weekends, cryptocurrency markets never sleep—offering flexibility for those with day jobs or unconventional schedules.

Setting Up Your Trading Foundation

Step 1: Choose the Right Platform

Your trading platform is your gateway to the markets. For beginners, you need something that balances powerful features with user-friendly design. This is where BYDFi beginner’s tips become invaluable.

BYDFi has built its reputation on making crypto trading accessible. Founded in 2020 and serving over one million users across 190+ countries, the platform follows the philosophy of “BUIDL Your Dream Finance”—encouraging users to take action toward their financial goals rather than just dreaming about them.

Step 2: Create and Secure Your Account

Getting started takes just a few minutes:

- Sign Up: Visit the platform and provide your basic information

- Enable Two-Factor Authentication (2FA): This adds a crucial security layer

- Complete Verification: While you can start with basic verification, completing full KYC unlocks all features

Security should be your top priority. BYDFi implements multiple protective measures including cold storage for the majority of user assets, multi-party approval systems for transactions, and segregated accounts that keep client funds separate from company operations. The platform also maintains a Protection Fund to safeguard user assets.

Step 3: Fund Your Account

BYDFi supports multiple deposit methods to accommodate beginners worldwide:

- Credit and debit cards

- Bank transfers

- Third-party payment providers (Apple Pay, Google Pay, Banxa, Transak, Mercuryo)

- Crypto transfers from other wallets

The platform supports over 100 currencies, making it easy to start trading regardless of your location.

Before You Risk Real Money: The Demo Advantage

Here’s a secret that separates successful traders from those who blow up their accounts: practice without risk first.

BYDFi offers every user a demo account loaded with 50,000 USDT in virtual funds. This isn’t just play money—it’s your testing ground. The demo environment mirrors real market conditions, letting you:

- Familiarize yourself with the platform interface

- Test different trading strategies

- Experience the emotional aspects of winning and losing (without actual financial consequences)

- Build confidence before going live

Spend at least a few weeks in the demo environment. Track your performance. If you can’t maintain consistent profitability with fake money, you’re certainly not ready for real funds.

Understanding Key Trading Concepts

Leverage: A Double-Edged Sword

Leverage allows you to control a larger position with a smaller amount of capital. For example, with 10x leverage, a $100 investment controls a $1,000 position. BYDFi offers leverage up to 200x on perpetual contracts, though beginners should start much lower.

Remember: leverage magnifies both profits AND losses. A 10% move against your leveraged position can wipe out your entire investment. Start with minimal or no leverage until you’ve proven consistent profitability.

Volatility: Risk and Opportunity Combined

Volatility measures how much and how quickly prices move. High volatility means prices are swinging dramatically—offering both greater profit potential and increased risk. Crypto markets are notoriously volatile, which is why risk management becomes absolutely critical.

Liquidity Matters

Liquidity refers to how quickly you can enter or exit a trade at a stable price. Major cryptocurrencies like Bitcoin and Ethereum have high liquidity, meaning you can execute large trades without significantly moving the market. BYDFi supports over 1,000 spot trading pairs and 500+ perpetual contract pairs, ensuring you have access to liquid markets.

Your First Trading Strategy: Start Simple

Beginners often make the mistake of jumping into complex strategies. Instead, master these fundamental approaches first:

Trend Following

This strategy is beautifully simple: identify a clear trend and trade with it. If Bitcoin has been climbing steadily with higher highs and higher lows, you look for opportunities to enter long positions during temporary pullbacks.

The key is patience. Wait for the trend to establish itself clearly before entering. Don’t try to catch the absolute bottom or top.

Support and Resistance Trading

Support levels are price points where assets tend to stop falling and bounce back up. Resistance levels are where prices tend to stop rising and retreat. By identifying these levels on your charts, you can plan strategic entry and exit points.

Moving Average Crossovers

This beginner-friendly approach uses two moving averages—typically a shorter period (like 10 days) and a longer period (like 50 days). When the shorter average crosses above the longer one, it signals potential upward momentum. When it crosses below, it suggests downward movement.

The beauty of this strategy is its objectivity—the signals are clear, removing emotion from your decisions.

Risk Management: The Skill That Saves Accounts

Here’s a sobering truth: most trading losses come not from bad strategies, but from poor risk management. You can have a winning strategy and still lose everything if you don’t protect your capital.

The One Percent Rule

Never risk more than one to two percent of your trading capital on a single trade. If you have $1,000, that means risking no more than $10-$20 per position. This might seem conservative, but it’s what keeps you in the game during inevitable losing streaks.

Stop-Loss Orders Are Non-Negotiable

A stop-loss automatically closes your position if the price moves against you by a predetermined amount. It’s your safety net. Set it before entering every trade, and never move it further away if the trade goes against you—that’s how accounts get destroyed.

Position Sizing Matters

Don’t put all your eggs in one basket. Diversify across different assets and strategies. BYDFi’s range of over 1,000 cryptocurrencies gives you plenty of options to spread risk intelligently.

Accelerating Your Learning Curve

Smart Copy Trading: Learn from the Pros

One of the most innovative features for beginners is copy trading, which BYDFi launched in January 2025. This allows you to automatically mirror the trades of experienced, profitable traders.

Here’s why it’s valuable for newcomers:

- Lower the learning threshold: You benefit from professional strategies while learning

- Automated execution: Trades copy proportionally based on your account size

- Risk control: Each copied trader uses an isolated sub-account, protecting your main funds

- Real-world education: See how successful traders manage positions in real-time

Think of copy trading as an apprenticeship. You’re not just copying blindly—you’re studying why profitable traders make certain decisions, when they enter and exit, and how they manage risk.

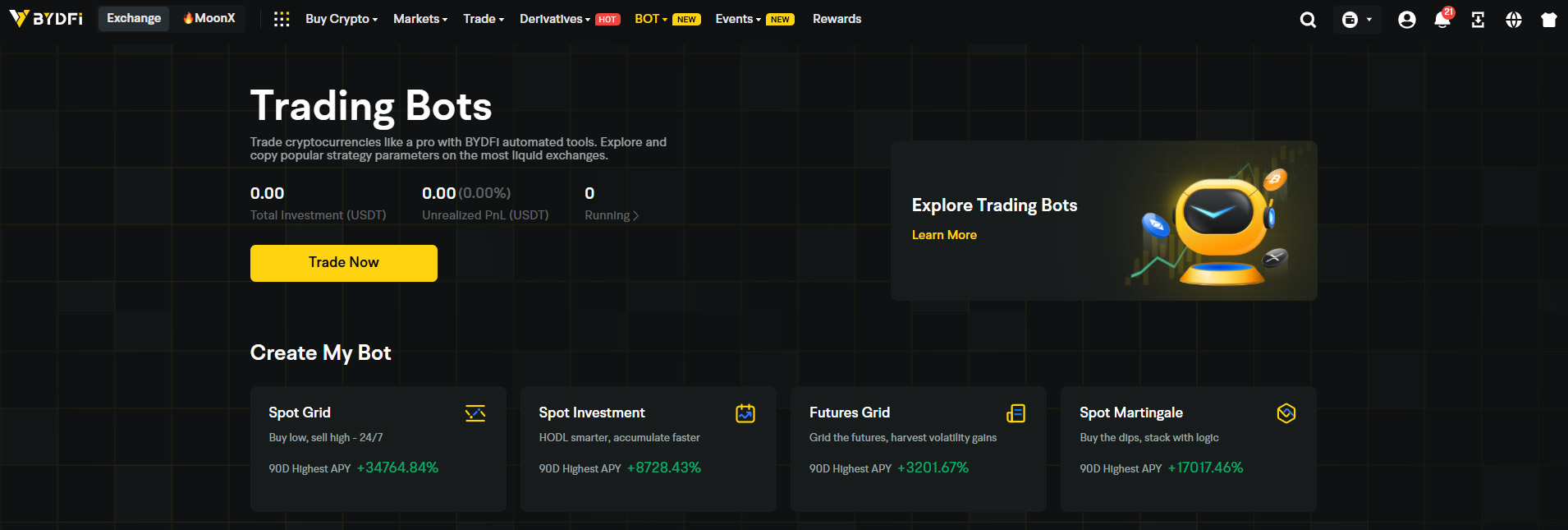

Trading Bots: Emotion-Free Execution

Emotions are a trader’s worst enemy. Fear makes you exit winning trades too early. Greed keeps you in losing trades too long. Trading bots eliminate these psychological pitfalls.

BYDFi offers several automated strategies:

- Auto-Invest: Dollar-cost averaging for long-term accumulation

- Grid Trading: Profits from price fluctuations within a range

- Martingale Strategy: Averaging down in volatile markets (higher risk, requires careful management)

These tools work 24/7, never need sleep, and execute your strategy with perfect consistency.

Expanding Into On-Chain Trading

As you grow more comfortable, you might explore the world of on-chain trading and memecoins through MoonX, BYDFi’s Web3 gateway. Launched in April 2025, MoonX represents BYDFi’s evolution into a dual-engine CEX+DEX platform, offering access to over 500,000 memecoin trading pairs on Solana and BNB Chain.

MoonX features like Smart Money Tracking and the Alpha leaderboard help identify trending tokens with real potential, while built-in risk filtering helps you avoid scams. It’s crypto trading for the next level—but master the basics first.

Building Your Trading Plan

Successful trading isn’t random. It requires a structured approach:

Set Realistic Goals

Forget about getting rich overnight. Instead, focus on consistency. A steady 5% monthly growth without leverage compounds into impressive returns over time. Start small, prove your strategy works, then gradually scale up.

Define Your Trading Style

Are you a day trader making multiple trades daily? A swing trader holding positions for days or weeks? Your lifestyle and personality should guide this choice. BYDFi’s 24/7 crypto markets accommodate any schedule.

Create Your Rules

Document everything:

- Which markets you’ll trade

- Your entry and exit criteria

- Maximum risk per trade

- Daily stop-loss limits

- Position sizing formulas

Write these rules down and follow them religiously. Consistency comes from discipline, not inspiration.

Keep a Trading Journal

Track every trade with details about your reasoning, emotions, and outcomes. BYDFi’s platform provides transaction history, but maintain your own detailed records. Patterns emerge over time that reveal your strengths and weaknesses.

The Psychological Game

Trading is 80% psychology and 20% strategy. Here’s what to expect:

The Five Phases of a Trader

Phase 1: Beginner’s Luck – You might win early on, which can breed dangerous overconfidence.

Phase 2: The Wake-Up Call – Reality hits. Losses come. This is where most quit.

Phase 3: Breaking Even – You’re not profitable yet, but you’ve stopped losing money. This is actually progress.

Phase 4: Consistency Emerges – More green days than red. Profits remain modest but regular.

Phase 5: Mature Trader – You’ve handled drawdowns, refined your approach, and achieved sustainable success.

Understanding these phases helps you recognize that early struggles don’t mean failure—they’re part of the journey.

Managing the Emotional Rollercoaster

Set a daily maximum loss limit. When you hit it, close your platform and walk away. This single rule prevents emotional revenge trading that destroys accounts.

Similarly, don’t get carried away after big wins. Overconfidence leads to oversized positions and sloppy risk management. Stay level-headed in both victory and defeat.

Real-World Success Through Partnership

BYDFi’s commitment to sustainable growth mirrors the mindset needed for trading success. In August 2025, the platform announced a multi-year partnership with Newcastle United, one of England’s most historic football clubs. As the Official Cryptocurrency Exchange Partner, BYDFi joins forces with a team known for resilience and long-term vision.

Michael Hung, Co-founder and CEO of BYDFi, captured this philosophy perfectly: “Lasting success, on the pitch or in finance, comes from doing the right things, repeatedly, over time. We’re honoured to partner with Newcastle United and to support a mindset where belief meets steady practice.”

This isn’t just corporate speak—it’s the exact mindset every beginning trader needs to adopt. Quick wins mean nothing. Consistent execution over time is everything.

The partnership also reflects BYDFi’s global expansion and commitment to reaching new audiences. Newcastle United’s growing international fanbase—ranking second among European clubs for broadcast audience growth since the 21/22 season—mirrors BYDFi’s own expansion trajectory across 190+ countries.

Your Action Plan: The Next 30 Days

Ready to move from theory to practice? Here’s your step-by-step roadmap:

Week 1: Foundation Building

- Open your BYDFi account and complete verification

- Explore the platform in demo mode

- Study one trading strategy in depth

- Set up your trading journal

Week 2: Strategy Testing

- Execute at least 20 demo trades using your chosen strategy

- Track every trade’s reasoning and outcome

- Identify patterns in your wins and losses

- Refine your entry and exit rules

Week 3: Risk Management Focus

- Practice position sizing calculations

- Test different stop-loss strategies

- Simulate a losing streak—can you stick to your rules?

- Explore copy trading to see how professionals operate

Week 4: Going Live (Small)

- Deposit a small amount you can afford to lose

- Execute your first real trades with tiny position sizes

- Follow your plan exactly

- Treat these as paid education, not profit opportunities

Common Beginner Mistakes to Avoid

Learn from others’ errors:

Overtrading: More trades don’t equal more profits. Quality over quantity always wins.

Ignoring Fees: Trading costs add up. BYDFi’s competitive fee structure (0.1% for spot, 0.02%/0.06% for derivatives) is designed to be beginner-friendly, but fees still matter on frequent trades.

No Stop-Losses: “It’ll bounce back” has destroyed more accounts than any other phrase in trading.

Following Hype: Just because everyone’s talking about a coin doesn’t mean it’s a good trade. Do your own analysis.

Overleveraging: Start with 2x-3x maximum until you’re consistently profitable. High leverage should be earned, not experimented with.

Quitting Too Soon: Success takes time. Give yourself at least six months of serious practice before judging your potential.

Resources for Continued Growth

Trading mastery is a journey, not a destination. Continue learning through:

- BYDFi’s Help Center: Comprehensive guides and tutorials

- Community Engagement: Join BYDFi’s global communities in multiple languages to exchange ideas

- Market Analysis: Stay updated through BYDFi’s platform insights and trending markets features

- Copy Trading Analytics: Study the statistics of successful traders you follow

- VIP Program Benefits: As you grow, BYDFi’s VIP program offers enhanced features and lower fees

The Bottom Line: Your Trading Future Starts Now

Making your first trade is both simpler and more complex than you might think. The mechanical process—opening an account, depositing funds, clicking buy or sell—takes minutes. Building the knowledge, discipline, and emotional control to trade successfully takes months or years.

But here’s what matters: you’re taking the first step. By reading this guide, setting up a demo account, and committing to deliberate practice, you’re already ahead of the majority who jump in recklessly.

Remember BYDFi’s founding principle: “BUIDL Your Dream Finance.” BUIDL is more than crypto slang for “build”—it’s a call to action. Dreams without action remain fantasies. Whether you’re aiming for a side income, financial independence, or simply understanding markets better, the path forward requires one thing: taking that first trade.

Start small. Learn continuously. Manage risk religiously. Stay patient.

Your journey from zero to first trade—and eventually to consistent profitability—begins with a single decision: to start. The markets are waiting. Are you ready?

Ready to begin your trading journey? Create your BYDFi account today and access demo trading, educational resources, and a global community of traders at www.bydfi.com